Lockheed, Boeing and Raytheon race to meet demand from US allies

From the Chinook helicopter to the F-35, the Stinger missile to the Patriot defence system, American defence contractors are expecting a surge in international demand © Bloomberg, Lockheed Martin, Getty Images, US Army

Ken Moriyasu, Nikkei Asia diplomatic correspondent YESTERDAY

Japan last month succeeded in obtaining the green light from the US state department to purchase 150 air-to-air missiles that can be loaded on its F-35 fighters.

The principal contractor for the $293mn deal is Raytheon Technologies. The proposed sale of the AIM-120 missiles, the US government said, “will improve Japan’s capability to meet current and future threats by defending the Japanese homeland and US personnel stationed there”.

The same day, Singapore secured permission to buy laser-guided bombs and various other munitions from the US for $630mn. Four days earlier, Australia won a nod to acquire 80 air-to-surface missiles developed by Lockheed Martin for $235mn. South Korea, meanwhile, will spend $130mn on 31 lightweight torpedoes to use with its MH-60R helicopters for anti-submarine warfare.

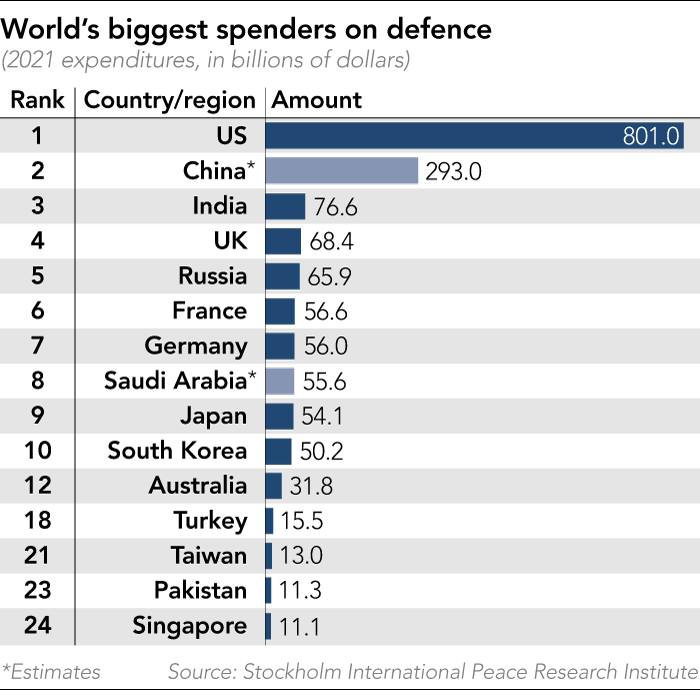

It has been a busy few months for the Defense Security Cooperation Agency, the Pentagon arm that oversees foreign military sales. In the first seven months of this year, the agency has facilitated 44 such deals, including an $8.4bn potential sale to Germany of 35 F-35 fighters. The 44 cases are up from 25, 43 and 40 cases in the same period of the previous three years.

While negotiations for such sales take months, and the recent flurry may not be a direct consequence of the Ukraine war or tensions over Taiwan, top US defence contractors are united in saying that they see an international bonanza ahead.

But this golden period comes with a caveat: supply chain constraints. Leaders at Lockheed, Raytheon, Boeing, Northrop Grumman and General Dynamics all spoke of the difficulty of securing parts and labour during recent earnings calls.

Like most manufacturers, defence contractors have built dispersed supply chains, because it is economically advantageous to seek the least expensive and most productive sources.

“When disruptions don’t occur, this practice benefits producers and consumers alike,” Bradley Martin, director of the RAND National Security Supply Chain Institute, told Nikkei Asia. “When they do occur, whether the reason is a pandemic or a natural disaster or an international conflict, there’s wide impact, sometimes in unexpected ways.”

Covid-19 and the Ukraine war are just such disruptions. If China increases military pressure on Taiwan — as seen recently when it responded to US House Speaker Nancy Pelosi’s visit to the self-ruled island with large-scale military drills that prompted ship and flight diversions — it could add to the complexities.

All this may interfere with the contractors’ otherwise rosy outlook amid an

accelerating Asian arms race.

“The situation that our customer base is facing has dramatically changed over the last three, four months,” James Taiclet, the chief executive of Lockheed, the world’s largest defence contractor, said at an earnings conference on July 19.

At the beginning of the year, China’s increased activity in the western Pacific was perceived as a “potential” concern, a watch item for the future, Taiclet said. But the Ukraine war has made the Pentagon and America’s allies realise that the threat of war is real.

“The Pacific is on higher alert because of the statements and actions of China recently, not to mention North Korea. The value of deterrence has never been greater,” he said. Events surrounding Taiwan have only seemed to hammer that point home, with China running exercises that Taipei said

simulated an attack.

Taiclet said it may take two to three years for the new demand to materialise into formal defence contracts. “The clutch isn’t engaged yet,” he said. This is especially true for international customers, who need to go through the foreign military sales process to secure approval from the state department and Congress.

US Marines load an F-35C Lightning II with AIM-120 air-to-air missiles in the Philippine Sea. Japan will buy 150 of the missiles for its own F-35s © US Marine Corps

But while the prospect of selling F-35s, F-16s and the recently popular high mobility artillery rocket system (Himars) excites Lockheed’s top brass, supply chain constraints that have haunted the contractor since the start of the pandemic still linger.

Lockheed’s sales for the quarter that ended in June were lower than expected at $15.4bn. Taiclet blamed supply chain challenges for part of the lacklustre performance and said the company anticipates that the problems will persist for the remainder of the year. “We’ve reduced our 2022 outlook to reflect that,” he said.

The sentiment was similar over at Boeing.

“We continue to experience real constraints,” Brian West, Boeing’s chief financial officer, said in an earnings call on July 27.

He said the risk of shortages includes engines, raw materials and semiconductors — all core components for the company. “To stabilise production and support our supply chain, we’re increasing our on-site presence at suppliers, creating teams of experts to address industry-wide shortages, utilising internal fabrication for search capacity and managing inventory safety stock levels,” he said.